I had $2 million dollars in crypto locked on a wallet

Yes, I had $2 million dollars locked away on a crypto-hard wallet that I couldn’t access because of a forgotten password.

But let’s start from the beginning…

In 2013 I started to learn everything I could about the world of Bitcoin and cryptocurrency. It was clear that a new “internet of money” was being born.

I started reading, writing, buying, and experimenting with the world of Bitcoin and everything around it. I almost started a company with the premise of letting people more easily buy and sell Bitcoin. I’ll add that one to the woulda, coulda, shouda list.

As we now all know, a few years later the ecosystem started to pick up. More people were getting involved, including some of my friends.

One of those friends had been making a living as a professional poker player. Instead of only trading cards and chips on digital poker tables, he now also started to trade various cryptocurrencies on a number of exchanges.

I was however busy with my day job building startups and didn’t have time anymore to focus on the crypto world. But, I still wanted to get in early on some of the emerging, off-the-beaten-path technologies that most people hadn’t heard about yet.

So in 2018, my friend Jesse and I were chatting and decided we should make a larger, more concentrated bet on an alternative coin. I would transfer him the money and he would buy and hold the coins for us.

And that’s exactly what we did.

On January 18, 2018, I sent my friend 2 BTC, which at the time was about $12,500/BTC. And with my 2 BTC, and his 2 BTC, together, we bought about $50,000 of a different coin called Theta at about $0.21 per token. This seemed a bit crazy at the time since the logical, sensible part of our brains told us we were basically lighting money on fire.

This is what lighting money on fire looks like.

“Someone’s sitting in the shade today because someone planted a tree a long time ago” – Warren Buffet

That was my plan.

To buy and hold, and not look at it for a very long time.

A few weeks go by…

We get a notice from the exchange where we had purchased and been storing our Theta coins. The exchange was about to shut down because the Chinese government was putting them out of business. Apparently, the Chinese government was working to ensure they had much more control over Bitcoin and the ecosystem. If we didn’t pull our coins and tokens out of the exchange by a certain date, we’d lose it all. I guess that’s China for you.

So we had to move the coins. We asked…

“Should we keep them?”

“Sell them?”

We decided to keep them. HODL!

Jesse bought a Trezor One hardware wallet and moved the coins onto the device for safekeeping. A hardware wallet is sort of like a digital lockbox for cryptocurrency, where the private information is stored within a physical electronic device. It looks a bit like a USB stick. We managed to move our coins mere minutes before the exchange disappeared.

Life went on.

I forgot about the coins and really the rest of my crypto holdings for that matter and just got back to work on my business.

And then…

Prices crashed. It was a nuclear winter in crypto land.

My $25k was now probably worth a few pennies on the dollar and at that point in my life, I just didn’t want to deal with the emotional roller coaster of big swings in the crypto markets. I had enough on my mind with work and didn’t want to be distracted and stressed with these insane markets. I wanted to sell off all of my positions and just ignore the crypto world for a bit.

So I asked Jesse to transfer me my coins so I can sell them and be done with it.

“I can’t do that.”

I asked, “What do you mean you can’t do that? Just send them or sell them.”

And then he said something that would set us off on a wild adventure:

“I forgot the password!”

You see, this is remarkable for two reasons. First, Jesse remembers everything. He remembers all of our friend’s license plate numbers from high school. After all, he plays poker for a living playing 8 tables at a time, knowing the odds, and remembers how probably dozens of different players play the game. In fact, one of the first places we heard about Theta was from another poker player!

Secondly, if you guessed the password incorrectly too many times, the device self-destructs. I mean, it doesn’t actually blow up, but the entire contents erase and our coins would be lost forever! The good news however is if you forget the password, you can always restore the device using a recovery seed which is basically a 24-word passphrase. Jesse wrote this down on a piece of paper while originally setting up the Trezor, but it got thrown away by accident along the way.

We were screwed!

At this point, I was almost relieved. After all, the investment basically went to zero and in many ways, it made living with that shitty investment decision a little bit easier to stomach.

I forgot about the coins and went on with my life again.

Until…

The nuclear winter in crypto land was over. Prices started to go up again.

Our $50k was back to about half.

Prices went up again….back to $50k.

Now we figured we should really try to get this wallet open.

“Dan, you’re an electrical engineer. You can figure it out!” I should have paid more attention in class because there was no way I would figure this out. And even if I did, I had absolutely no time to even try.

At this point, I had convinced myself I would never see the money again so I ignored it.

Prices went up again!

$75k.. $100k…$200k!

At this point, we decided to get a bit more active to figure this out. Jesse started googling the earth to find people that could help.

We found engineers that allegedly hacked this wallet before, but they weren’t interested in helping.

$400k!

We found a few engineers who seemed like they could pull it off but they either flaked, weren’t interested or ran into obstacles quickly. Some of those engineers were even engineering professors from my school.

$800k!

Finally, we found some guys in Switzerland who claimed they had done this before. They seemed like they could actually pull it off. The problem now was that I needed to meet them in Paris at their secret lab and Europe was shut down due to COVID. For a few weeks, we went back and forth trying to figure out how we could rendezvous in Europe to pass off the wallet but the combination of the shutdown and not being able to physically go to the lab to watch them hack the wallet made the prospects of this working a bit grim.

A new update…

We see a press release about Theta:

$1.5mm!

We were back at square one.

Group chats with our friends were becoming ridiculous. I told Jesse if we couldn’t find a technical way to free the coins, we’d find a chemical way to free the coins. As in, we’d go away for a weekend and I’d feed him hallucinogens until he remembered the password.

We found another engineer in Portland. He was a part of a famous hacker group back in the day and testified on the Senate floor saying, “Yes, we can take down the internet in 30 minutes.” We had been exchanging emails to see if he could be our guy to figure this out and free the coins.

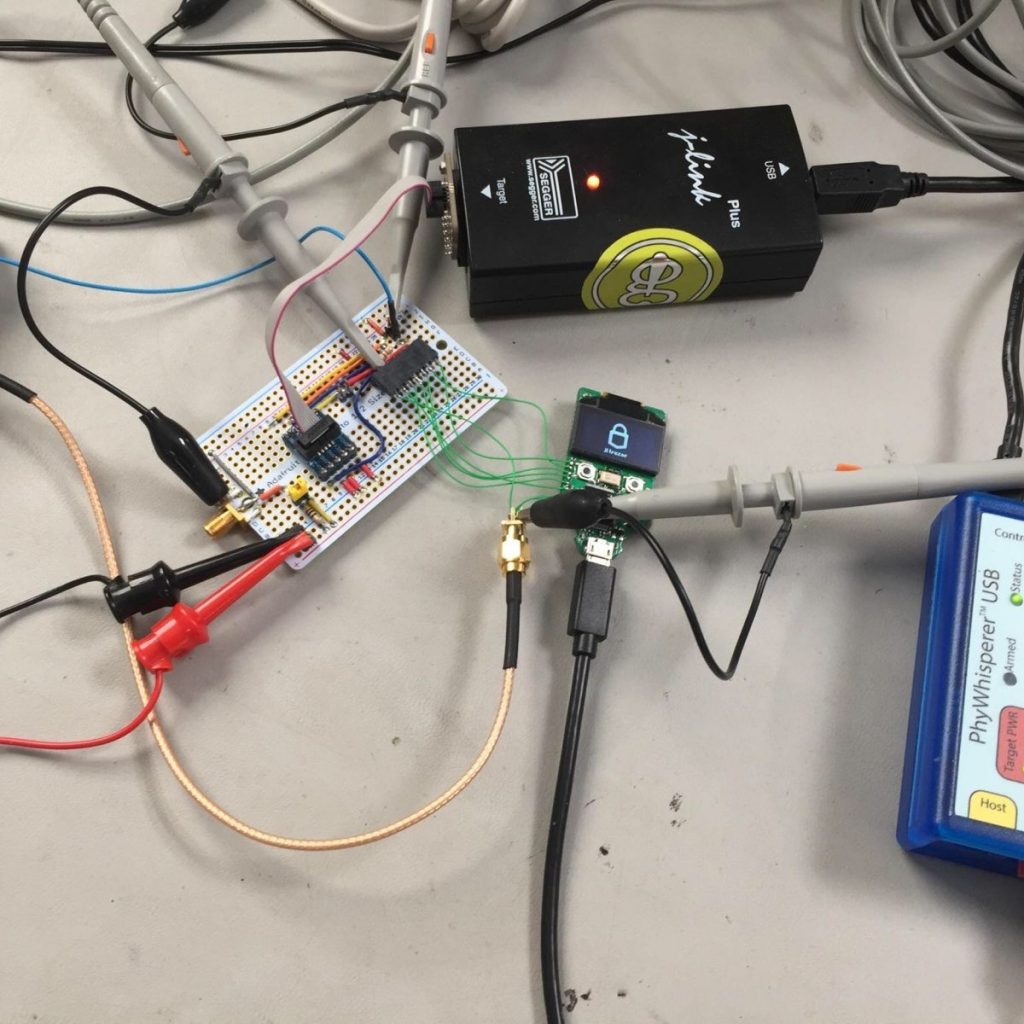

He bought some hardware and special devices, made a few calls to some friends in the hacking world, and off he went, trying to hack an exact make and model of our Trezor to prove he could do this.

Over the next few weeks, he went to work and would update us on his progress.

$2.0mm!

I said as soon as he could prove success, I’d book a ticket out the next day to come to meet him in person with the wallet. We also talked about the fact that if he could actually pull this off, he could offer these services to many more people like us that are locked out of their wallets. In addition, we agreed that we’d have to film this hack because one way or the other we would have to tell this story.

It would either be a triumphant story or a miserable and expensive story, but either way, we were going to document the whole thing.

And sure enough, I eventually get an email with something to the effect of…

“I did it!”

The next day, I drove to Jesse’s apartment, picked up the wallet, and booked my flight to Portland to meet the hacker, Joe Grand.

The rest they say is history…

After two days in Portland, spending a few hours in his lab performing the attack on the wallet, he freed the coins!

At the time the wallet was officially hacked and unlocked, the total value of the wallet was about $2.5 million dollars.

At the lowest point, it was about $20k. At the highest, it was just over $3 million.

Joe is now making his services available to anyone that is locked out of their wallets with a new company called offspec.io.

Did we sell the coins? Yes, we sold some.

The rest? We put on another Trezor and locked it away.

And that’s my story about how I had $2mm locked on a crypto wallet.

And you can see the whole thing go down in this video.

And, The Verge wrote about it here too.